10x ResearchAccording to research by the US Federal Reserve (Fed), a more aggressive rate cut than expected on September 18 could increase economic concerns rather than confidence. 10x Research analysts say such a situation Bitcoin (BTC) $60,045 He assesses that it will cause a decline in risk assets such as.

10x Research: A Rate Cut of More Than 25 Basis Points Could Shake Markets

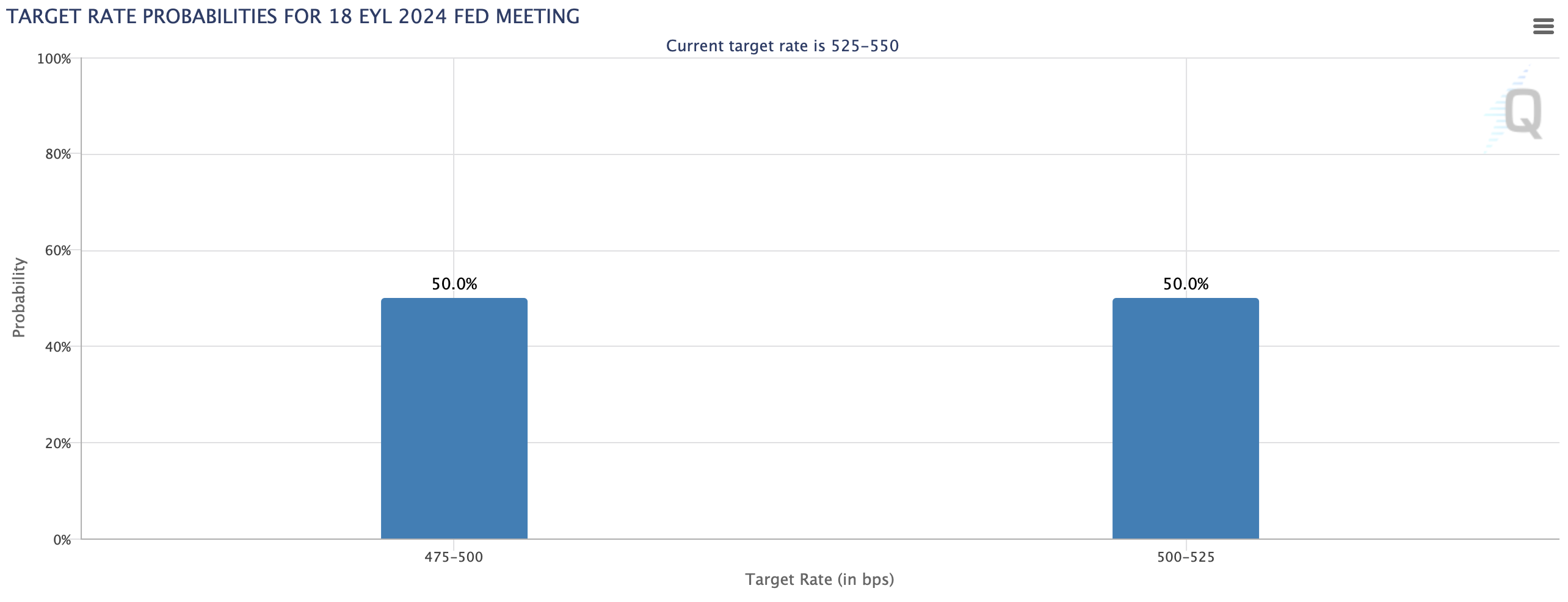

Latest from the USA employment market data It has set the stage for the Fed to cut interest rates, with the first move expected to come next week, on September 18. Markets are currently giving a 50% chance of a significant 50 basis point (bps) rate cut planned for next week.

10x Research expects the liquidity expansion cycle to begin with a significant 50 basis point cut on September 18 crypto moneywarns that this could be a negative start for risky assets, including . Central banks like the Fed usually adjust interest rates in 25 basis point increases or decreases. However, in 2022 tightening cycle Larger changes, such as the 50 basis point and 75 basis point increases seen during the 2010-2011 inflation period, signaled urgent measures to bring inflation under control, and these measures caused risk aversion in markets to gain strength and harden.

According to 10x Research, an announcement of a 50 basis point rate cut next week could raise economic concerns or echo the perception that the Fed is slow to address the impending economic slowdown. Such a scenario could prompt investors to invest in Bitcoin and stocks may lead them to reduce their investments in volatile assets such as

50 Basis Point Interest Rate Cut on the Table

Founder of 10x Research Markus Thielen He touched on this issue in his latest client bot published on Monday and said, “While a 50 basis point cut by the Fed could cause deeper concerns in the markets, the Fed’s primary focus will be on reducing economic risks rather than managing market reactions.” Thielen, who correctly predicted that BTC would rise to $70,000 in the first quarter, underlined that such an interest rate adjustment could also come.

As of now Chicago Mercantile ExchangeThe Fed’s (CME) FedWatch tool shows there is about a 30 percent chance the Fed will cut rates by 50 basis points, bringing them to a range of 4.75 percent to 5 percent next week. “The probability of a 50 basis point cut is only 29 percent,” Thielen said. “After the Fed was caught off guard in July, labor market“There are growing voices that he is late and ignoring signs of weakness in his administration.”

Risky Assets Are Still in Danger, Says Macro Trader

This perspective reflects the broader consensus among traditional market experts. Macro trader Craig Shapiro “The Fed doesn’t want to start with a 50 basis point cut because frankly, there’s no need for the economy to panic at this point,” he said from the X account. Shapiro also noted that liquidity-dependent markets will push for a significant rate cut and that there will be corrections in risky assets until the Fed agrees to higher cuts, saying, “We’re back in this zone. Risky assets will correct until the Fed gives in and gives us what it wants. We need to find the Fed’s selling price from now on, but where the economy is right now and the economic data show that growth is still slow and the prices of risky assets (stocks, credit spreads, etc.) are still very high.”

Historical data interest rate reduction cycleIt shows that the beginning of the 2020-21 period does not always have a stimulating effect on asset prices, regardless of the magnitude of the initial move. It reveals that the expectation of the Fed easing is the main driving force behind Bitcoin’s upward trend from $20,000 in January 2023. However, it is also a matter of great curiosity whether the potential interest rate cut is priced in at current market prices.

Disclaimer: The information contained in this article does not contain investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should carry out their transactions in line with their own research.