LINK price has remained under pressure through September, slipping into a bear market and briefly touching its lowest point since August.

Yet, the signs of a turnaround are emerging. With a cup-and-handle pattern forming, LINK’s strategic reserves expanding, and even the institutional momentum is firmly building, LINK crypto could be preparing for a pivotal rebound.

LINK Price Supported by Strategic Reserves

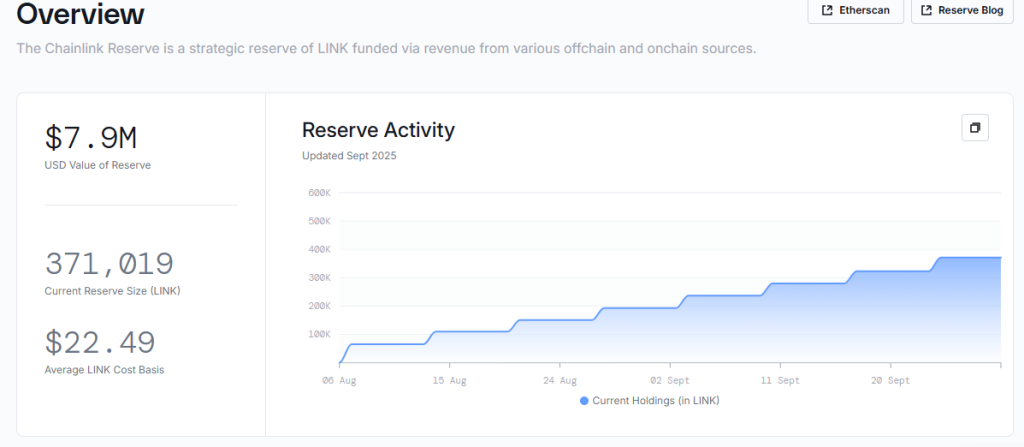

A key development cushioning the LINK price is the Strategic LINK Reserves. Since early August, it has accumulated more than 371,000 LINK coins, valued at around $8 million at an average cost basis of $22.49.

These reserves are being created by redirecting on-chain and off-chain fees toward direct LINK token purchases.

This strategy is significant because demand for LINK crypto is closely tied to adoption. As Chainlink’s network grows, fees are expected to rise, thereby increasing reserve accumulation.

The steady buildup not only supports the LINK price forecast narratives but also signals their firm confidence in long-term value creation.

ETF Anticipation Adds Fuel to the Narrative

The LINK price chart may also be gearing up for momentum as altcoin ETF speculation intensifies. Proposals for Grayscale and Bitwise LINK ETFs are under review by regulators, a development that could attract U.S. investors and further institutionalize demand for Chainlink crypto.

Recent data confirm heightened interest in altcoin ETFs, with products such as Ethereum, XRP, Solana, and Dogecoin already experiencing strong inflows.

If LINK price USD receives similar regulatory traction, it could unlock a new phase of market participation. This aligns with broader expectations of increasing demand for real-world asset tokenization, an area where Chainlink has positioned itself as a leader.

Supply Shock and Investor Accumulation

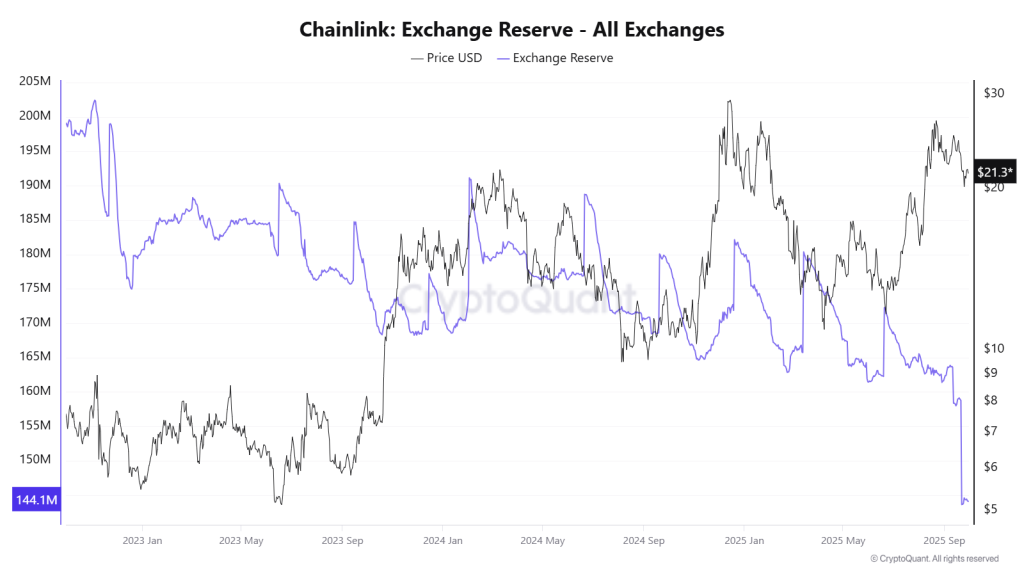

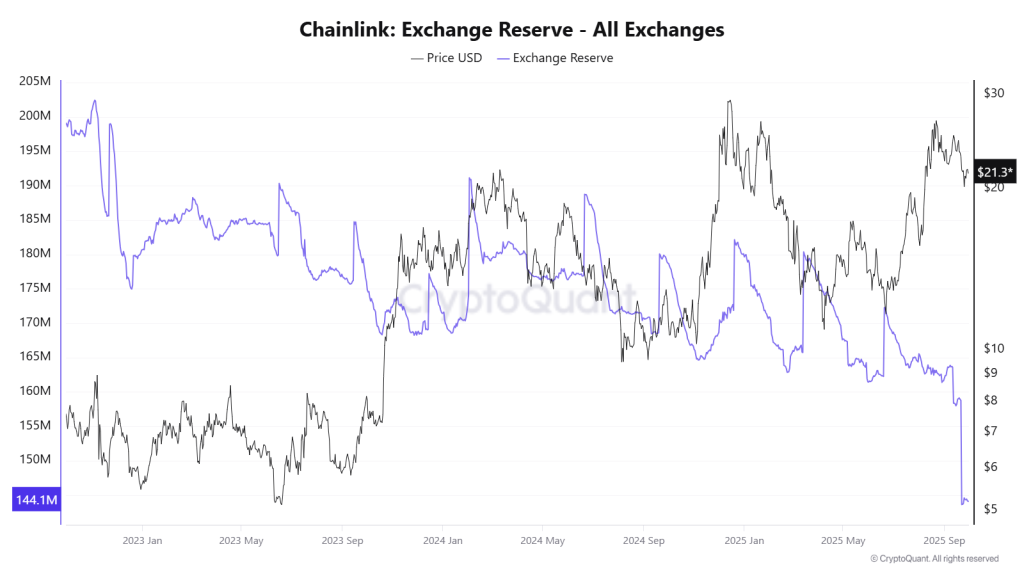

Another factor that may potentially drive the LINK price prediction is the rapid decline in exchange reserves. In just 30 days, investor wallets have absorbed nearly 20 million LINK tokens.

Such a structural shift, often viewed as a precursor to a supply shock, indicates growing confidence from larger players.

The reduction in available supply coincides with broader institutional headlines. This convergence suggests that LINK price today could be entering a period where demand significantly outpaces immediate supply, creating favorable conditions for upward movement.

SWIFT Ledger and Institutional Partnerships

Similarly, another optimistic news build momentum for LINK crypto and was reinforced at the Sibos 2025 conference when SWIFT unveiled its plans for a blockchain-based shared ledger built with Consensys and over 30 major banks, including JPMorgan and HSBC.

The announcement was such a bold move it quickly reignited interest in Chainlink, given its role in bridging traditional finance with blockchain infrastructure.

Even the Chainlink itself highlighted its corporate actions initiative on X confirming the news that they really haveexpanded to 24 global financial institutions, including Swift, ANZ, Schroders, and Zürcher Kantonalbank. These partnerships add credibility to LINK price forecast expectations by demonstrating real-world adoption and institutional trust.

Technical Outlook: LINK Price Prediction

On the technical front, LINK price has formed a cup-and-handle pattern, a structure often associated with bullish reversals.

If the $20 floor continues to hold, the next potential target lies around $28, marking mid-range resistance.

Beyond that, the broader rising channel, established since 2023, still frames the longer-term trend.

Under this structure, the LINK price in USD could extend toward higher resistance near $47 if momentum persists, suggesting room for significant upside in the months ahead.