As the last day, we saw that 13 Republican representatives refused Genius in the procedural vote, as they almost rest on Trump. But then Trump was interested in them one by one, and today he finally received 3 laws. So what will change from now on. How will the process proceed for these laws? We discuss all the details you are curious about.

US Crypto Monetary Law approved

Crypto Money Week It is exciting. After the pause, the House of Representatives gave approval for Genıus and Clardy. Following the overwhelming stablecoin law, two other laws were adopted. With the joint support of the two parties, 102 Democrats and 206 Republican approved the previously accepted and accepted stablecoin arrangement (GENIUS). Stable, which serves the same purpose by the House of Representatives, was shelved in order not to extend the process.

Trump will sign Genius a few hours after the US markets are opened tomorrow. Genius, which organizes Carty and stablecoins, which offers a framework to regulate crypto currencies, is now putting crypto money markets on a path of no return.

The circuits of traditional finance will be able to enter comfortably in the environment where crypton is legally legitimized and certain areas are officially regulated. So when JPM takes a stablecoin tomorrow, nobody can tell him what you are doing. In November 2022, if we saw such a declaration of intention, we would have witnessed that all the institutions responsible for all financial supervision were squeezed to that bank. Conditions are changing very quickly.

Anti CBDC law prohibits the Central Bank digital currencies due to US surveillance concerns. Trump presented this as a promise of election and Crypto Coins Something good for. While the CBDC is banned, the majority Ethereum  $3,435.37 The stablecoins exported on their network are opened. So crypto coins are opened. CLARITY will be voted in the Senate after the approval of the House of Representatives. Just as GenIus received the approval of the House of Representatives after receiving the Senate approval today. Genius will probably have already signed by Trump at this time. There will be some additions to the substances in the Senate for CLARITY, so we cannot say that it is finalized. Crypto Coins We can talk about it is a good draft that reduces uncertainties for CFTC powers.

$3,435.37 The stablecoins exported on their network are opened. So crypto coins are opened. CLARITY will be voted in the Senate after the approval of the House of Representatives. Just as GenIus received the approval of the House of Representatives after receiving the Senate approval today. Genius will probably have already signed by Trump at this time. There will be some additions to the substances in the Senate for CLARITY, so we cannot say that it is finalized. Crypto Coins We can talk about it is a good draft that reduces uncertainties for CFTC powers.

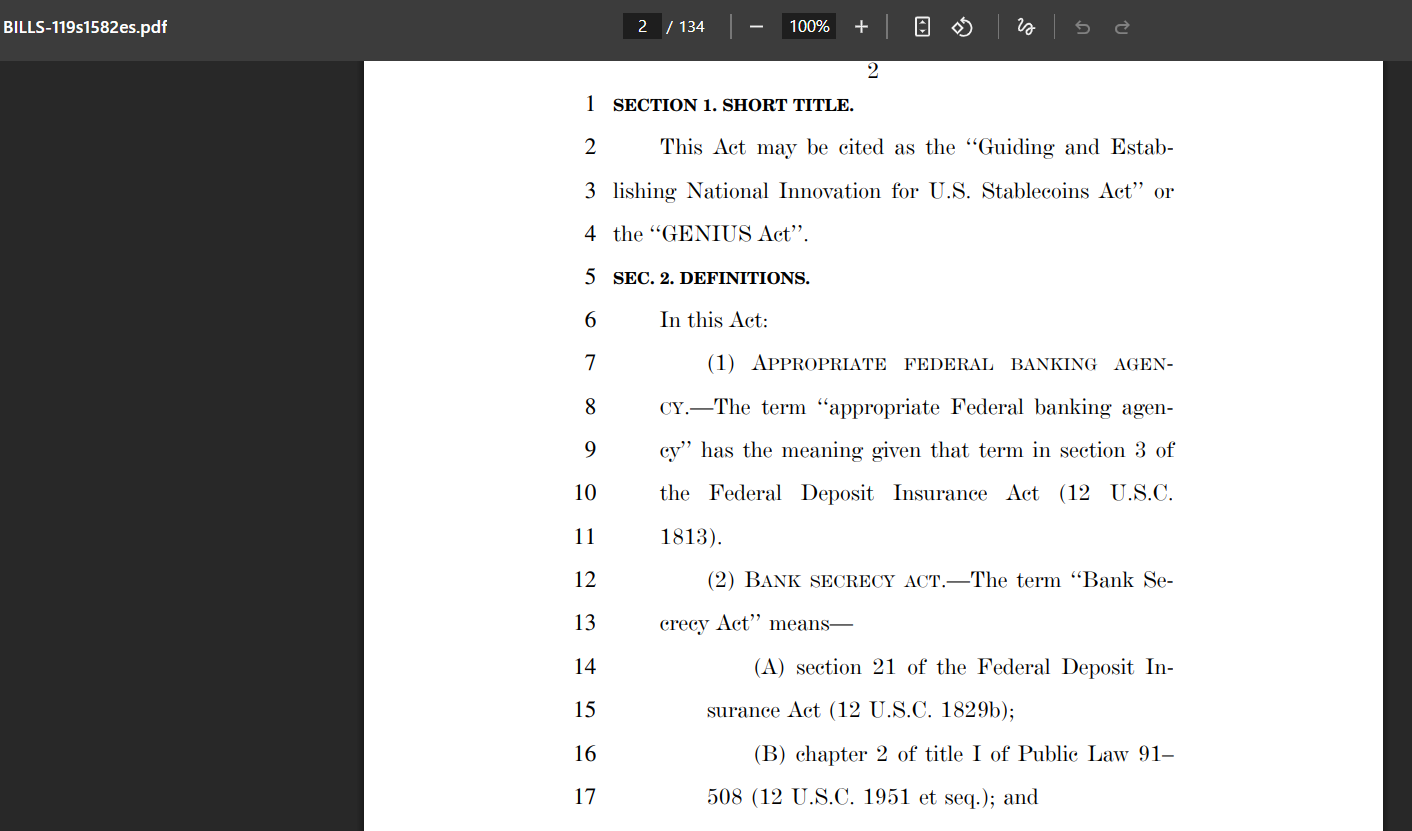

Details of the GENIUS law

The most important thing for us is that it will be signed tomorrow GeniusDetails of ‘s. According to the law, only the US issued by the US will be able to export stablecoin in the region. Foreign companies wishing to export Stablecoin have to meet the conditions of compliance to serve US customers. Out of scope of direct transfers between individuals or personal wallet use in export and sales restrictions.

Stablecoin exporters should support the USD index tokens with a reserve at EN 1: 1. The reserves can not be the token of the exporter as the fraudulent Do Kwon does, US dollar, treasury bills (≤93 days maturity), repo transactions, federal reserve deposits. In other words, what the reserve asset would be clarified by the law.

In accordance with the rules of transparency, the reserves should be explained to the public every month. If you pay attention to all this, such as extensive security fences to prevent investors from being defrauded. Firefighters, refund, such as repayment, should clearly declare stablecoin exporters.

The prohibited (except for specific exceptions) is prohibited. Interest payment is prohibited. This is one of the most important issues. Stablecoin exporters cannot pay interest. So what does that mean? “Believed stablecoins in defi protocols will attract attention.” In other words, we will probably see that the defi protocols in the Ethereum network bring more profit. This week’s CRV rise and so on.

The activities of the companies that export stablecoin are limited. What is limited to? These companies can only make stablecoin export, fire, reserve management. He can’t go into other things. At the time of the article, Sharplink made a filing for the sale of $ 5 billion, and the company receives ETH with the cash it obtained. (EthereumWhy does this company pour billion dollars to Ethereum? As mentioned above, the issue is connected to Genıus and ETH price exceeds $ 3,400 is not in vain.

Returning to the law, those who are convicted of certain crimes cannot be a stablecoin exporter. For example, when SBF gets out of prison for the second time, investors cannot at least take a stablecoin and defraud. Public companies must obtain special approval for the export of stablecoin.

Stablecoin exporters should apply for approval from the federal regulator by applying. Applications are concluded within 120 days. Companies receiving rejection can appeal. In other words, the road to be followed by companies that say that I will export stablecoin was determined. When you remember the words of ız If you do not know the way, we will not offer you free guidance, hold a consultant ”words, the legal units of crypto companies are probably filled today.

Stablecoin exporters with a size of over $ 50 billion are subject to control, albeit outside the USA. So Tether is talking about. Those who export stablecoin without permission will receive 5 years of imprisonment. Penalties are certain for things such as not complying with reserve conditions and wrong declarations, but many details do not concern investors.

State regulators have the authority to supervise the exporters in the states. At the point where the FED is required, it can intervene in exporters (extraordinary conditions in events). Exporters have to implement BSA (Banking Privacy Law) and sanction harmony programs. Stablecoins that do not comply with the rules can be banned from US citizens.

In case of bankruptcy, stablecoin Owners have the right to receive priority on reserve assets. Well Circle If you go bankrupt USDC There will be no zero dollars. This is actually a guarantee that will eliminate the Peg problem on the stock markets. The stories of the stablecoin depge (to be a depge for 1 dollar for 1 %and over) are over) stories.

The law will enter into force 18 months after the date of publication or 120 days after the regulatory rules are completed. Stablecoins are not considered as securities or commodities.

The full text of the law is roughly 134 pages so I tried to summarize as much as possible.

Responsibility Rejection: The information contained in this article does not contain investment advice. Investors should be aware that crypto currencies carry high volatility and thus risk and carry out their operations in line with their own research.